Published on the 28/01/2015 | Written by Beverley Head

ASX-listed IT services company UXC Limited has started 2015 at a fast clip with growing enterprise demand and a push into the healthcare sector…

The listed Sydney-based company UXC has announced that strong sales at the tail end of 2014 will see it post earnings “substantially above” what was forecast at the company AGM in November. Having originally forecast pre-tax profit would rise 50 percent when it announces its financial results at the end of February, the company is now forecasting an 85 percent profit surge with revenues rising 10.4 percent.

The company has also said that it has sliced its debt from A$51.9 million at the end of 2013 to around A$20.5 million.

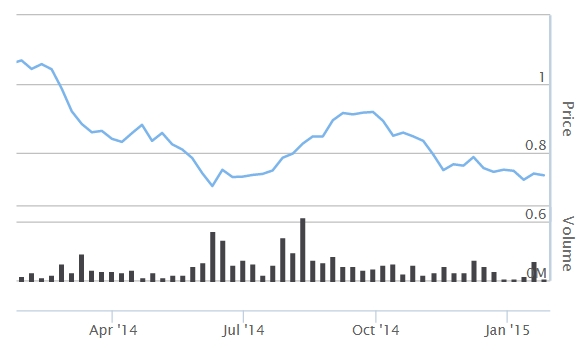

Investors were happy to hear the news and have boosted the company’s share price – but trading volumes remain thin, suggesting investors are sitting tight and waiting for the company’s strategy to bear even juicier fruit.

What is playing to UXC’s strengths is the need for enterprises to implement information systems that are agile enough to respond to the continuous disruption being experienced by just about every sector.

Sean Mathieson, executive general manager for emerging solutions and strategic opportunities in UXC, has predicted even more disruption in the coming year with IT departments again challenged to implement and operate solutions that can keep up with end user expectations.

Mathieson has forecast that successful enterprises will embrace both cloud technologies and mobile solutions in 2015 in order to better meet organisational needs.

Besides tackling the fundamental technology needs of all enterprises, UXC has also established a series of vertical industry strengths.

UXC Connect for example has developed a range of solutions targeted at the healthcare market.

According to Ian Poole, UXC Connect CEO, particular focus was being paid to patient experience and healthcare business’s financial performance, which was essential given Australia’s ageing demographic, specialist skills constraints, and constrained economy.

A range of solutions are being rolled out to the sector – from specialist clinical management systems to front line applications. The latter make use of collaborative platforms such as mobiles and unified communications to allow carers access to real-time information when attending patients while providing their employers with real-time information about their employees’ physical whereabouts and safety.

The UXC group has been acquiring a number of subsidiary businesses but comprises the following entities in the enterprise application space:

- UXC Oxygen – SAP solutions

- UXC Eclipse – Microsoft solutions

- UXC Redrock – Oracle solutions

- UXC Connect – Integration solutions

- UXC Consulting – Strategy

ASX:UXC share price and volumes over the last 12 months (current A$0.735):