Published on the 24/02/2015 | Written by Clare Coulson

New Zealand’s largest retail telco says an 80 percent premium above median international wholesale pricing is “unnecessary”…

Spark says ComCom’s pricing could be at least $12 a month per customer higher than it should be, according to analysis by two independent international expert firms engaged by Spark. The ‘Final Pricing Principle’ levels were proposed in a draft decision by the Commerce Commission announced in December last year, at the time prompting a round of price increases by Spark.

Spark’s general manager of regulatory affairs John Wesley-Smith said Spark believed the large increases proposed by ComCom were “unnecessary” and “should be reversed when the Commission sets the final charges later this year”.

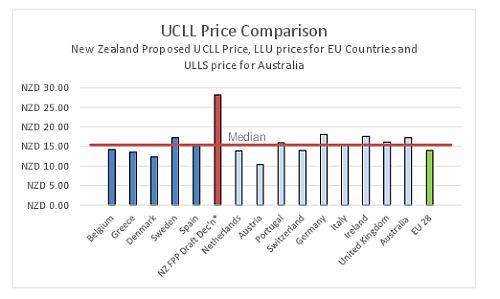

The Commission’s first attempt at modelling the new prices proposed a charge for landline access that was 80 percent higher than the median price in 14 other comparable countries – and 60 percent higher than the next most expensive country. At the time the Commission said that the copper prices came out higher than those indicated in the ‘Initial Pricing Principle’ due to “uniquely New Zealand factors, such as the dispersed nature of the rural network”.

Wesley-Smith, however, claims that Spark’s experts have shown that it was choices made by ComCom in the draft modelling process that are responsible for the difference in cost, stating: “it does not cost 80 percent more to provide landline access in New Zealand than everywhere else on a like for like basis”.

TUANZ CEO, Craig Young, said it was interesting to see that Spark had come out and put a number on what it thinks the price should be – essentially “front-footing the issue” with the Commission.

TUANZ agrees with Spark that the draft pricing proposition released in December is too high. “We think the price should be more in line with the Initial Pricing Principle, if not a little lower. From an end user perspective we want to be paying ‘the right price’ which is the lowest possible price for end users that still enables Chorus to continue to be able to invest in and maintain the network.”

Obviously Chorus would like to have a higher price to maintain its revenues and Spark would like to have a lower price because wholesale costs are a significant input to all its prices, he said. What ComCom and the telecommunications providers are debating now are the settings of the model that generates the prices. “If I step back and look at it objectively, this is exactly the sort of argument that I would expect the two parties to run,” Young said.

A Chorus insider indicated that Spark are naturally arguing against wholesale input prices going up “so they can avoid a margin squeeze or avoid having to raise prices and then lose further share.” Industry analysts estimate that Spark’s market share has fallen to less than 50 percent of the retail copper broadband market and 30 percent of the fibre broadband market.

Wesley-Smith believes, however, that the analysis commissioned by Spark has proved that the Commission’s draft model loads an enormous amount of unnecessary costs onto New Zealand consumers. By making some conservative adjustments to the Commission’s model, one expert firm commissioned by Spark came up with a charge for landline access of $16.64 a month – compared with $28.22 proposed by the Commission. The other analyst said this charge could be reduced even further if the model took more account of newer technologies such Fixed Wireless Access (FWA).

“With these adjustments the wholesale charges in New Zealand would be much more in line with those applied overseas – and this would translate into lower retail broadband prices than we have today,” Wesley-Smith said.

“We think we’ve shown enough to put the onus on the Commission to change its model to exclude these costs – or if not, to explain why it would be in New Zealand’s best interests to hold broadband prices up by setting wholesale charges 80 percent higher than in other countries,” he said.