Published on the 10/09/2012 | Written by Brad Spencer

The ‘Spatial industry’ has for decades appreciated the real, exciting and powerful benefits of geospatial analysis. But if geospatial tech is so wonderful and is such a ‘no brainer’, why haven’t small to medium enterprises embraced the technology?…

There are approximately 1.5 million SMEs in Australia representing about 40 per cent of the Australian workforce and contributing around half a trillion dollars to Australia’s GDP. SMEs make a substantial contribution to domestic production in a wide range of industries and much of the productivity gains in these SMEs can be attributed to the high take-up of information technology and more recently the increasing use of the internet. Given this huge potential market hungrily adopting new smart technologies, why has business use of mapping technology been slow to take off? Geospatial technologies have been around for a long time, but the entrenched use of this technology is largely limited to niche markets within a number of sectors such as public, defence, mining, finance and others. It’s rarely found in the 20-99 man businesses that are selling products direct to consumers. Yet these organisations have recognised the value of investing in IT and are operating with an internet presence. There are several reasons why an increased take-up has not eventuated. Firstly, the spatial industry tries to over sell technology into this market. These businesses do not want to invest in GIS and all that goes along with that investment – it’s simply not core to their business. Targeting these organisations as potential GIS customers is a waste of time. Secondly, spatial technology is generally over-priced for these markets. These organisations are reluctant to make any financial investment in technology unless its benefits are clearly apparent over and above any alternative investment. So asking SMEs to invest in thousands of dollars for access to the latest imagery or access to the latest geocoding engine will simply fall on deaf ears. Google have done more to commoditise spatial data and thus get it in the hands of the broader community more successfully than all the spatial industry’s efforts.

“Asking SMEs to invest in thousands of dollars for access to the latest imagery or access to the latest geocoding engine will simply fall on deaf ears”

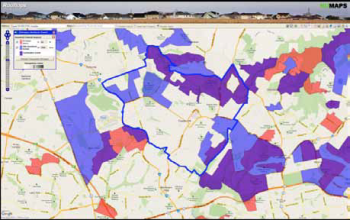

Thirdly, geospatial analysis applications are typically not targeted to particular operational needs. They are invariably trying to be all things to all markets and therefore over complicated. Generic open source GIS products are available but they are not being used because there is too much of a learning curve and little data available even if they accept the benefits. Finally, these markets need clear proof of the benefits. There are rarely individual champions within organisations that get it and lobby within to invest in this technology. All the above probably only represent a few of the show-stoppers but they do indicate the magnitude of the challenge. If these markets are to embrace geospatial analysis these issues at least must be addressed. Case Study The target market for Rooftops is any SME that wants to identify households that are candidates for their product micro-marketing efforts. These are not vast swathes of suburbs or postcodes but a subset of properties that are more likely to be converted into a sale. These organisations may typically be selling solar panels, swimming pool products, outdoor pergolas, garden sheds, landscaping, etc. These are big ticket residential items that historically have been attacked with postcode/suburb wide mailout strategies. These strategies have proven to be expensive per converted sale. The objective of the Rooftops application is to use information to identify households that have an apparent capacity and/or a need for these products and are more likely to invest. Rooftops consists of a two-step analysis process: 1. Inspect the Demographics. In this first step the user has access to a demographic analysis tool that lets them iteratively identify the ABS Census Collection District (CCD) areas that on average have financial capacity to invest. Currently, this is based on economic capacity to spend (In Fig. 1 we are overlaying low Mortgage Stress with high Household Incomes). The user can vary these overlays interactively by simply changing criteria values in order to isolate high priority target CCDs (in Fig. 1. The CCDs rendered purple). Other analysis profiles can be supported such as based on education, employment, religion and other attributes. 2. Inspect the Individual Properties. Given that the user knows that the area they have identified has more financial capacity to invest, they can now invest the time and effort into looking at each individual property to identify those they would like to market directly to (Fig. 2). The user switches the base map to the high resolution imagery version and can zoom in and pan around to inspect each property within the target area. The address for any property can then be harvested into a list of addresses by the included reverse-geocoding tool. The result is a list of property addresses suitable for target marketing purposes. When inspecting a property the user can measure rooftops, backyards, etc with the measure tool and objectively include or exclude properties based on inspection of house aspect, existing landscaping and tree shadows etc. In Fig. 2 the user was measuring rooftops and harvesting addresses shown as red map symbols. In this application example, it was important to exclude houses with solar panels already installed. This type of application does resonate with SME businesses; it does not require any GIS software investment, no user training and can be accessed via a standard browser-based PC connected to the Internet. However, there are details that have to be sorted not least of which is pricing. As explained above enterprises will simply not invest time and money even in a simple web based application if it does not have an immediate return. In this case that is a list of remotely qualified sales leads. But they will invest once they are convinced that the cost per converted lead is affordable. SMEs simply cannot afford to waste any resources. Price for any web-based service inevitably comes down to different business model options. There are two ways to price such applications: a.) as a software product sale that delivers the software to the client to run on their own Internet server, or b.) as a software as a service (SaaS) offering that is hosted in the cloud and paid for under a subscription model. The preferred option would appear to be as a SaaS model because the SMEs see this as an operating expense which requires no capital outlay and can be terminated at any time – low cost of failure investment. The other key reason is that should they invest as a capital purchase they would need to arrange licensing agreements with at least three down-stream data suppliers. Under a SaaS model this is all undertaken for them by the provider of the service on behalf of all users of the service. However, the downstream suppliers of the data used in this or any similar application must look at this market in a different light to the typical GIS aware market. For example, there are limitations on geocoding and there are licensing costs for access to the most recent imagery that could make the whole exercise cost prohibitive and or impractical. Conclusion

By way of example, the Rooftops application has been developed and is being tested for its benefits in Sydney. The original objective of Rooftops was to demonstrate software development capability and to also leverage access to ABS census data in the form of online thematic map overlays. These can be draped atop of a Google Maps-like application or mashup. The result is a web-based application that has SME market appeal if packaged affordably. Fig. 1 Blue areas are CCDs where Median Total Household Income is greater than $9,000 per month, Red areas are CCDs where Median Mortgage Stress is less than 22% and the purple area is where the two overlap. Study area is Castle Hill in Sydney’s Hills district.

Fig. 1 Blue areas are CCDs where Median Total Household Income is greater than $9,000 per month, Red areas are CCDs where Median Mortgage Stress is less than 22% and the purple area is where the two overlap. Study area is Castle Hill in Sydney’s Hills district. Fig. 2 Red circles are harvested addresses

Fig. 2 Red circles are harvested addresses

It is clear that SMEs are a ‘greenfields’ market for geospatial analysis presented with the right applications and that data and network infrastructure are improving all the time to facilitate such initiatives. However, if these initiatives are to flourish and brave new markets breeched then the suppliers of the dependent resources need to re-package their offerings to accommodate these markets and cloud-based initiatives otherwise geospatial analysis will struggle to be adopted in the broader market place.