Published on the 10/10/2014 | Written by Clare Coulson

A “uniquely Kiwi” joint-venture will see a common mobile wallet available to Android smartphone users by early next year…

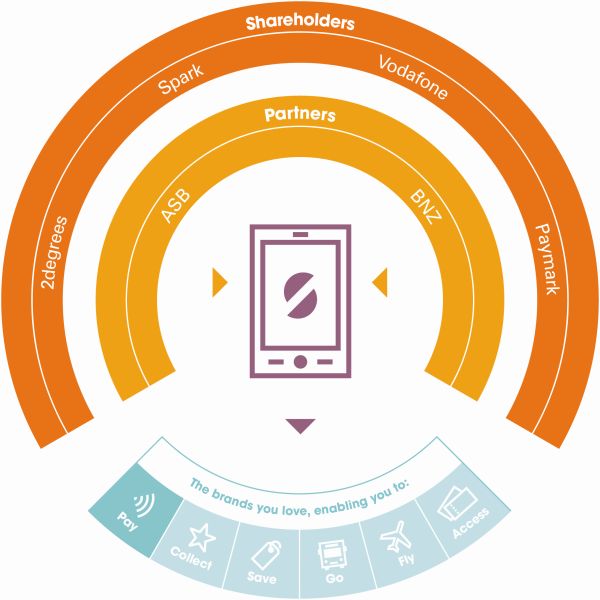

This week TSM New Zealand rebranded itself as Semble and announced that its mobile wallet of the same name is ready for a live pilot. Semble is an independent company founded in 2012 as a joint venture between Paymark, Vodafone New Zealand, Spark (then Telecom New Zealand) and 2degrees. The intention was to provide a common TSM, or trusted services manager, so that all New Zealanders could make secure payments, collect loyalty points and use public transport using NFC technology embedded in smartphones.

Today New Zealanders’ desire for the contactless experience with the smartphone at the centre continues to grow. We have already made over 20 million contactless transactions worth an estimated $735 million up to August this year, and 82 percent of Kiwis say they would not leave home without their smartphone.

Semble is positioning its mobile wallet solution as the common national platform for contactless transactions. It will provide the secure infrastructure that sits between service providers (such as banks, loyalty providers, merchants) and the mobile phone providers.

CEO Rob Ellis said the name Semble evokes “an assembly of parts and partners”, and that is what the mobile wallet is.

“We are creating a world where your bank cards sit in a virtual wallet on your smartphone together with your coffee cards, your reward cards and more,” he said.

Semble has been working with all of New Zealand’s mobile network operators, plus ASB, BNZ, Air New Zealand and Samsung to bring this mobile platform solution to market. Although it is starting with bank payments Semble has an open philosophy, which means that any organisation offering contactless transactions can participate in the wallet in the future. Semble expects that its wallet could soon include transport cards, loyalty cards, airplane tickets, concert tickers, hotel keys and more. Ellis called it a “uniquely Kiwi collaboration” driven by the same attitude that saw New Zealanders embrace the fledgling eftpos system 20 years ago.

Ellis also explained that Semble chose Samsung as a marketing partner for the initial roll out, not only because it holds the largest share of the massive Android smartphone market in New Zealand, but also because Andorid’s open nature complements Semble’s own open access philosophy. There was no mention of the role that Apple or its Apple Pay facility may play and Ellis said he is yet to speak to the company. That said, iPhones only make up 14.8 percent of the worldwide smartphone market according to IDC.

The roll out of Semble will begin next month with a 250-user live pilot after which Semble will be available to download from Google Play early next year.

To see the wallet in action and for more information, visit semble.co.nz