Published on the 09/11/2018 | Written by Jonathan Cotton

ASB treads with caution into blockchain with new trade solution…

Though some would pretend it’s not, New Zealand is still an agricultural export economy.

Trading as efficiently as possible has significant implications and technology is playing an increasing role in doing exactly that. Blockchain has been touted by vendors, and discounted by industry, as a saviour to the complexities of international trade.

Now, even the bankers are getting in on the action with the ASB announcing a new blockchain-based ‘Single Trade Window’ has been used for the first time to transact a consignment of meat (and money) across borders.

“In our case, [our requirements] were aligned with the capabilities of the blockchain technology.”

Created via a partnership between the Australian-owned bank and Kiwi blockchain tech start-up VerifyUnion, the platform enables exporters trading with overseas importers to upload, share and, importantly, settle all the relevant biosecurity and finance documents relating to a deal. In this case, a consignment from NZ exporter Greenlea Meats to a customer in South Korea.

“The proof of concept works off a blockchain tech layer and creates a secure ecosystem comprising of exporters, exporter banks, shipping companies, document processing entities, local logistics providers, the New Zealand Chamber of Commerce, other New Zealand local regulators, importers, the importer banks and importer logistics providers,” explains Andy Standley, project manager at VerifyUnion.

The single trade window digitises, records and shares three key areas of trade – operations, documentation and finance – by tracking the container, completion of tasks and shipping documents, on the purpose-built private blockchain.

“Our single trade window creates an ecosystem comprising of [export, bank and insurance] documentation, and at a later stage will link in [NZ] logistics providers and regulators, [as well as offshore] importers, banks and logistics providers,” says Greg Beehre, ASB’s GM Global Transaction Banking.

“This ecosystem enables better collaboration and adds operational benefits to all parties.”

The first trial is now complete after the platform was used by Kiwi meat exporter Greenlea Premier Meats to trade with a large Korean importer. (The single trade window was used in parallel to traditional trade documentation processes, but with real dollars being transacted.)

ASB and VerifyUnion worked on multiple iterations for several months before agreeing on the blockchain and the consensus model. All technical development was then completed by Verify Union, with ASB providing business and customer validations during the creation process.

The platform is the latest in a flurry of trade window launches, such as that created by Singapore’s DBS Bank – which recently tested a cross-border blockchain trade platform for agri-commodities, connecting about 4,500 farmers to Australian end-customers such as supermarkets and restaurants – not to mention IBM’s TradeLens and NZ Customs’ awkwardly-monikered, and entirely blockchain-free, Trade Single Window.

And there’s more functionality in the pipeline: “Soon we will also be able to track and log electricity consistency, temperature and humidity inside the container via IoT devices, which will form part of the third leg in the proof of concept,” says Standley. “This level of data provided to partners in the supply chain will provide a greater level of transparency and efficiency regarding the location, condition and authentication of the goods being transported.”

ASB are now preparing an air-freight blockchain Proof of Concept – as well as exploring other avenues where blockchain technology could add value. That’s a good sign for blockchain in New Zealand where real-McCoy use cases – as well as technical resources – can be scarce.

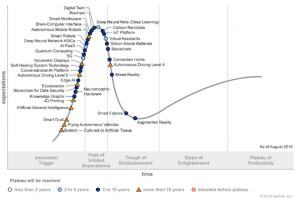

But that scarcity is probably for the best. In May Gartner cautioned that blockchain, in general, was “massively hyped” and that rushing into deployments could lead organisations to significant problems of “failed innovation, wasted investment, rash decisions and even rejection of a game-changing technology”. And now blockchain tech is entering the “trough of disillusionment”, at least according to the company’s new “Hype Cycle for Emerging Technologies” report.

“Digitalised ecosystem technologies are making their way to the Hype Cycle fast,” says Mike Walker, research vice president at Gartner. “Blockchain and IoT platforms have crossed the peak by now, and we believe that they will reach maturity in the next five to 10 years, with digital twins and knowledge graphs on their heels.”

It’s a position ASB is well aware of. The key to success, says Beehre, is making sure there is a legitimate business case to apply the tech to – not the other way around.

“You do have to be cautious to an extent so yes, we agree with Gartner’s caution,” he says.

“In our case, we were investigating options on digitising trade functions, to add operational efficiency and to improve security; which was perfectly aligned with the capabilities of the blockchain technology.”

Standley concurs.

“Blockchain, like any new technology, requires a real business case to be applied to,” he says.

“Blockchain can be used to replace old technologies, but any decision should be based on knowing what the problem is that needs solving.”