Published on the 06/12/2017 | Written by Donovan Jackson

IDC study shows end users view vendors in new light…

According to IDC New Zealand, the position of the traditional market leaders in the local IT services market – which it named as Datacom and Spark – is being challenged by cloud providers ‘such as Microsoft’. These cloud providers, the market watcher said, are now emerging as challengers to the incumbent service providers, as explained in its New Zealand IT Services Ecosystem Study 2017.

If that is indeed the case, it reflects how well the partners of the cloud providers are performing – and among those partners are, of course, Datacom and Spark Digital, the IT services division of Spark NZ. As a case in point, Datacom partners not only with Microsoft on its Azure cloud, but also on another nine competencies. The IT service provider also partners with Amazon Web Services and multiple other cloud providers.

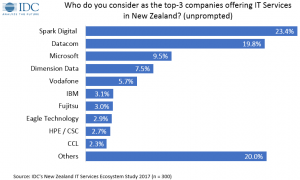

Asked ‘who do you consider as the top three companies offering IT services in New Zealand’, 23.4 percent of respondents to the study said Spark Digital, 19.8 percent Datacom and 9.5 percent Microsoft (see table).

Confused? So were we, so we asked IDC Senior Market Analyst, IT Services & Security Donnie Krassiyenko, for elucidation. “As you pointed out, both Datacom and Spark Digital are Microsoft’s partners. However, this study is reflective to end-user sentiment expressed by those taking part in the survey. Therefore, the results in this year’s survey indicated that Microsoft is holding a much higher rate of mindshare of New Zealand organisations.”

Krassiyenko said the study has been run by IDC in New Zealand for 15 years, focusing solely on the IT services market.

The reason it starts to get a little confusing is because cloud isn’t the same thing as IT services – well, not traditionally. As is the case with many definitions in the tech space, they can change over time, or simply mean different things to different people. And as Krassiyenko pointed out, the responses from the some-300 respondents to the IDC study are unprompted.

Continuing, he said the rise of cloud providers (perceived by respondents to be ‘service providers’) started to appear in the Ecosystem Study 2015, published in 2016. “That has eventually resulted in Microsoft – a cloud vendor, not an IT service provider – getting into the top-3 unprompted IT services providers in 2017.”

Shedding further light on the findings of its research, Krassiyenko explained: “This response by the survey participants reflects how end-user demand for platforms and hybrid solutions pushes cloud vendors’ market awareness. Awareness and perceived leadership – that is, whether the IT service provider is a leader or not – is important because it affects where and whom end-users go to when they decide to invest in an IT services or cloud solution.”

Which, in effect, means Microsoft is doing pretty well at winning ‘hearts and minds’. “These results indicate that Microsoft is becoming a trusted adviser and gatekeeper to a wider IT services provider market as perceived by New Zealand organisations. One key outcome of this perception is that Microsoft is finding itself in a stronger position to both influence the end-user and lobby its own interests to channel partners,” Krassiyenko confirmed.

There’s an elephant in the room by the name of Amazon Web Services. Depending which analyst is asked, it has somewhere between 31 and 35 percent of the global cloud market share (Synergy Research puts it at that upper limit and says it has more share than the next 5 competitors combined. And those competitors include Microsoft and Google.)

However, in New Zealand, said Krassiyenko, “AWS still has a relatively small awareness in the overall IT services landscape with only 1.3 percent selecting it as a top IT service provider; it is included into the “others” category. Also, AWS is considered as a pure cloud provider. In contrast, Microsoft is embedded across various layers of organisation’s IT – from legacy applications and infrastructure all the way to collaboration tools and cloud.”

However, like Microsoft’s appearance in 2015, he said AWS is a new appearance in the Ecosystem Study. “Three years ago, neither Microsoft nor AWS featured in the unprompted list of top IT service providers in the country. Conversely, IBM and Fujitsu [tech vendors, but also service providers] are the regulars in selected providers alongside Datacom and Spark Digital. They feature in the list as IT service providers (given their work in such areas as outsourcing, endpoint management, system integration, etc), although their work in the cloud space has evidently helped them to stay relevant to the market.”

Finally, Krassiyenko pointed out that that the cloud and IT services landscapes are different. “Both Microsoft and AWS are a lot more prominent when compared to their peers – that is, as cloud providers, not IT service providers. What we see here [in the IDC IT Services Ecosystem] is cloud vendors raising their awareness in the IT services space.”

Readers keen to see IDC’s NZ IT Services Ecosystem will need an IDC subscription.