Published on the 16/03/2021 | Written by Heather Wright

Forecasts get real as AI, blockchain slide…

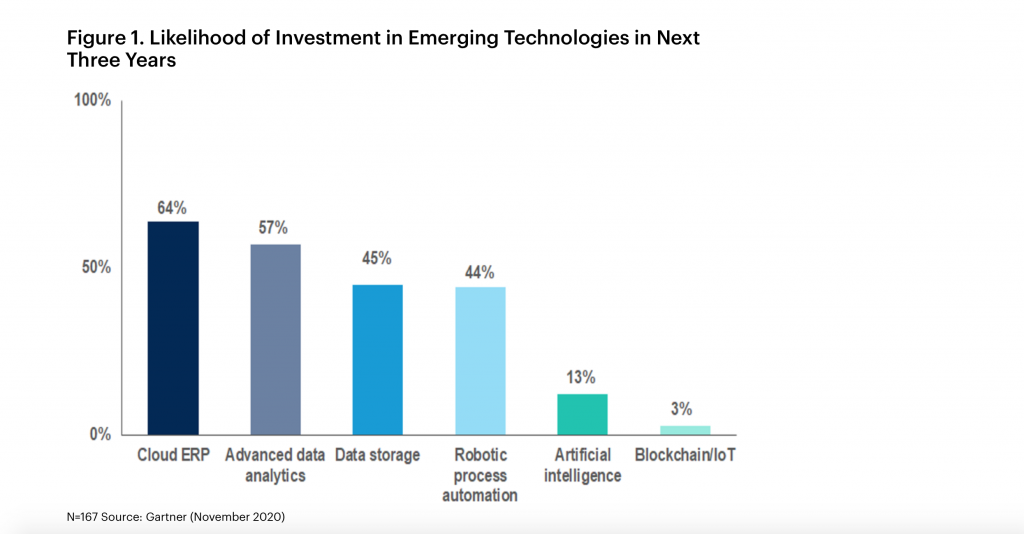

Forget blockchain and AI, it’s the less sexy – or perhaps just less hyped – offerings of cloud ERP, advanced data analytics and data storage which are grabbing the attention, and wallets, of CFOs.

A survey from Gartner has just three percent of the 167 finance organisations surveyed flagging any likelihood of investment in blockchain in the coming three years. (Internet of things, too, sits at a lowly three percent.)

Artificial intelligence fares slightly better at 13 percent but the two much-hyped technologies trail the front runners of cloud ERP (64 percent), advanced data analytics (57 percent), data storage (45 percent) and robotic process automation (44 percent).

Use cases are limited and not applicable to most of finance work.

The report follows earlier Gartner forecasts for growth in spend across the Australian and New Zealand markets this year. The analyst firm expects Australian enterprise IT spend to grow 4.0 percent, to AU$98 billion, following a one percent drop in 2020, with New Zealand spend expected to grow at a much lower 2.4 percent, to NZ$12.5 billion.

“As with many business functions, Covid-19 has accelerated the pace of finance investment in digital transformation,” says Dan Garvey, vice president in the Gartner Finance practice.

In fact, 69 percent of business leaders say digitalisation initiatives are accelerating and most expect digital technologies to dramatically transform their industry by 2026, Gartner says, with CFOs critical enablers of those enterprise ambitions.

Garvey says digital investment and transformation are no longer things that CFOs can take a ‘wait and see’ approach on or throw small investments at.

But the survey findings show they’re also not about to throw money at emerging technologies which pose implementation challenges while lacking a similar prospect for return on investment as the lower hanging fruit of cloud ERP, data analytics and storage – we’re looking at you AI and blockchain.

Companies are, Garvey says, looking for those lower hanging fruit which can drive meaningful gains for the business.

“There’s no doubting the potential of building your own AI, but is the finance organisation capable of realising that potential?,” Garvey says.

In a similar vein, he says blockchain might have great transformative potential, but right now out of the box use cases are limited and not applicable to most of the work the finance organisation conducts.

Back in May 2020, it was RPA that was the front runner for CFOs, with 24 percent of finance executives expecting more spend on the technology, versus 20 percent expecting increased spend on cloud-based ERP technologies and 19 percent anticipating more spending on advanced analytics.

“It’s not surprising to see cloud ERP as the top choice for finance organisations because it is a maturing technology with clearly established benefits that offer an escape from the bloated ‘monolithic’ ERP systems of yesteryear,” Garvey says.

“Advanced analytics, data storage and RPA are also all established technologies with well-proven use cases in finance.”

It’s also possible to get some of the benefits of AI, without the headaches through embedded AI in many cloud and advanced analytics offerings, solving the challenges around integration and in-house expertise, Garvey says.

Cloud adoption and data and analytics were among Gartner’s 10 digital ‘must-do’s’ for CFOs for 2021, alongside the likes of waste reduction, digital upskilling and employee productivity.