Published on the 02/12/2014 | Written by James Bergin

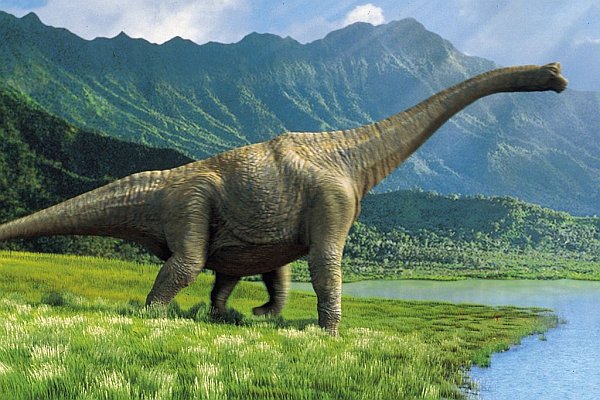

ASB chief architect James Bergin refutes the suggestion that banks are dinosaurs in danger of serious disruption and explains how ASB is getting prepared for the ‘next big thing’ in banking…

It’s 20 years ago, almost to the day, since Bill Gates described banks in Newsweek magazine as “dinosaurs” that Microsoft could “bypass”. While he clarified the statement a year later, the retraction did not pack nearly as much punch as that prehistoric jab. Was he right? Are banks on the path to extinction? Are they slow and cumbersome (assuming that was the inference) and unable to see the inevitability of their demise? Many of us working in the industry certainly don’t subscribe to that gloomy outlook. The fastpaced digital world is certainly bringing lots of change to financial services. But for those who are brave enough, it is also bringing opportunity, innovation and, (believe it or not) plenty to be excited about. Recently at ASB, we’ve been discussing internally how we are really not ‘just a bank’, and that we are increasingly seeing ourselves as a technology company that is licensed and trusted to provide financial services. As the bank’s chief architect, I spend a lot of time thinking about the challenges inherent in that description. For example, what is expected of a modern tech company nowadays? Agility? Flexibility? Innovation? Not words one would necessarily associate with traditional bank architecture. So, how do we need to change to better succeed in a digital world? One of the conclusions I have reached is that I don’t believe we should expend too much effort trying to accurately guess what the next ‘big thing’ will be – I’ll leave that to the futurists. Rather than trying to architect for a prediction, my team and I are focused on ‘architecting for disruption’. Launching ASB’s Application Programming Interface (API) platform in September was a good example of the steps we are taking to try to anticipate further disruption, design flexibility into our systems, and embrace the new, digital world. Publicly-available APIs are not new – especially not to tech companies such as Google, Apple and Twitter – but they are a very new concept for banks. Our API platform provides developers with easier access to some of our real-time data (such as interest rate feeds and location information) for use in their new digital applications. And this is just the beginning. In the near future, we’ll look to broaden the API platform to offer even more information and capability. We’ve described it as a ‘bridges not walls’ approach to the way we share information. Historically, banks have spent most of our time designing and building the most secure walls we can to protect the precious information we hold – and we have become very good at it. But it is no longer enough to just protect and defend. Customers want access to their finances wherever they are, whenever it suits them and, increasingly, in whichever form they choose. So we are now building some robust and safe bridges into our environment, which will make it easier for trusted developers to securely access and use some of our financial information and capability in a variety of apps and digital experiences. Previously the only way to directly interact with the bank digitally was as a person sitting in front of a web browser or using a mobile app. But through an API, a registered and trusted application can get that information for itself. In other words, it’s software talking to software, and is important in establishing a vibrant, digital financial ecosystem. I’m excited by these sorts of changes that see a bank breaking down traditional barriers and extending our trusted financial services capability to power the digital economy. This evolution means you won’t want to bypass your bank – we’ll be too relevant for that! James Bergin is the chief architect for ASB Bank in New Zealand, where he and his team work with the senior leadership to ensure the architecture of ASB aligns with its strategy, and where he is accountable for driving an innovation and research agenda to identify strategic technology and business opportunities.

Nice one, James. Brilliant article. A “bridges not walls” approach is awesome. The only way to prepare for disruption is to face the future with an open mind and embrace challenge. Peter Drucker: “The best way to predict the future is to create it.” On that thought… Congrats! on architect-ing ASB’s API platform. The future of banking sure looks exciting! Best wishes ahead…