Published on the 02/04/2015 | Written by Clare Coulson

The contents of discussion documents presented by the IRD are good news for business and the ICT sector, presenting an opportunity to modernise the nation’s fleet of ERP and financial systems…

Minister of Revenue Todd McClay this week released two public consultation documents as part of the $1.5 billion project to modernise and simplify the tax system: a green paper called Making Tax Simpler and a consultation document called Better Digital Services.

In an address to the Wellington Employers’ Chamber of Commerce on the release of the documents, Minister McClay said that while international research shows that New Zealand’s tax policies are competitive, straightforward, consistent and predictable there is “an urgent need to improve the way that taxes are administered” in order to help businesses flourish.

Prior to releasing the documents, the IRD has been meeting regularly with accountants, the tax industry and the ICT industry, including MYOB and Xero, to understand how these improvements might be achieved. It has also run a pilot targeted at small business owners in Hawkes Bay that garnered feedback from more than 1500 people on how to simplify tax administration.

According to the Better Digital Services document, the Government is determined that digital services must be designed with the customer at the centre and provide a seamless experience through all available channels. It also noted that due to the rapidly changing nature of technology, any package of services which is designed for customers will need to be sufficiently flexible to keep pace with technology changes.

One area that Minister McClay highlighted as ripe for improvement is GST and PAYE handling. The Government has been working with 20 representatives from small, medium and large software developers to co-design how GST and PAYE information can be transferred to Inland Revenue in the future. One way is to create systems that allow the two-way transfer of information between the business’s payroll system and Inland Revenue’s, requiring businesses to do their IRD calculations and returns from within their payroll and financial systems. Alternatively they could complete them manually online, but either way paper forms are likely to continue to be phased out.

Minster McClay said that integrating tax information into normal business practices is an attractive idea, but acknowledged that it creates some challenges in potentially requiring every employer to move to digital. “We need to be careful we’re not simply shifting costs from government to business,” he said.

Commenting on the documents Peter Vial, Tax New Zealand leader at Chartered Accountants ANZ said: “What I’m really keen to see are rules and systems [that] recognise that a ‘one size fits all taxpayers’ approach is not essential. In many situations a ‘near enough is good enough’ approach to tax compliance should be appropriate for individuals and small businesses.

“One hundred percent accuracy may be ideal but it can make tax compliance time consuming and wasteful for people who just want to get on and run their lives and their businesses.”

Some of the other highlights in the consultation document include:

- Investigating options for simplifying the calculation of provisional tax

- Integrating employers’ tax obligations into business processes

- Providing individuals with an online return which lists PAYE income information received from their employer

Miniser McClay pointed out that while it is clearly desirable to avoid unnecessary compliance costs imposed on business in moving to digital channels, there may be one-off costs associated with software being able to interface with Inland Revenue’s. Vendors will have to develop the updated interfaces required to post data to IRD systems and balance the cost of that work against hoped-for increases in revenue from license maintenance fees paid for upgrades. There is a huge range of ERP and financial systems in use in New Zealand, some quite antiquated and not all will be suitable for integrating with IRD systems, so the change is likely to precipitate investment in more modern systems.

The Making Tax Simpler green paper focuses on tax administration and aims to introduce New Zealand to the overall direction of the tax administration modernisation programme. It seeks feedback on where the policy framework is heading with consultation on the topic closing on 29 May 2015.

The second consultation document, Better Digital Services outlines proposals for greater use of electronic and online processes allowing faster, more accurate, more convenient interactions with Inland Revenue. Consultation closes on 15 May 2015.

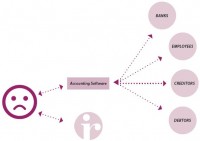

Current state

Business customers need to interact with both their accounting software and Inland Revenue to meet their obligations.

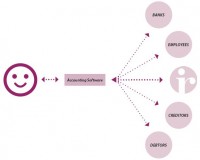

Future state

Business customers only need to interact once with their accounting software to meet their obligations.

Below are some of the questions that the IRD is putting to the public in the Better Digital Services consultation document:

- Do you think you would move to digital services for your tax interactions, if high-quality digital services which met your needs were offered? Even in this situation, can you foresee any interactions which you would not want to carry out using digital services? What would they be?

- What could Inland Revenue do to create an environment that supports new customers to adopt digital services?

- What could Inland Revenue do to support existing customers using digital services?

- Do you agree Inland Revenue should provide specific assistance to enable some customers to use digital services? What forms do you think that assistance might take? How long do you think that assistance should be provided for?

- Who do you think will not be able to move to digital services, even with specific assistance?

- Do you agree that when some people have a digital services option available, but by not using it are imposing a cost on everyone, they should be supported, encouraged and, if necessary, ultimately required to use digital services?

- Do you agree that where some people (such as employers and tax agents) who choose not to use digital services, and by doing so are denying others (such as their employees or clients) the benefits of the new tax administration system, that first group should be required to use digital services?

- Do you agree that the Commissioner should use her existing powers under the Tax Administration Act, which include the requirement to have regard to compliance costs, to facilitate the move to digital services?