Published on the 08/04/2021 | Written by Heather Wright

Customers and content as enterprise software spend surges…

Local information technology spend is on the up this year, with line of business the new funding source for many digital initiatives and business software spend a big mover across both Australia and New Zealand.

Gartner’s annual technology spending forecast for 2021 has the New Zealand market set for a 2.7 percent increase in spending, following last year’s 1.6 percent decrease. The Kiwi increase is far below the global average of 8.4 percent, but will still see New Zealand spend inch just ahead of pre-pandemic levels, reaching NZ$12.8 billion this year, over 2019’s 12.7 billion.

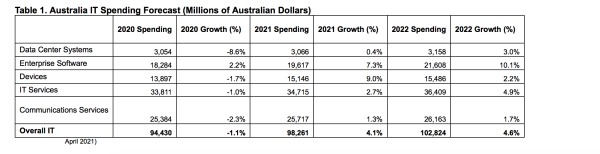

The Australian market, meanwhile is forecast to see a 4.1 percent jump this year, after a 1.1 percent decline last year, with all segments returning to growth. The return to growth will see Australian spend hit $98.3 billion and is an increase over pre-pandemic spend of $95.5 billion in 2019.

John-David Lovelock, distinguished research vice president at Gartner, says of the local increases: “Last year, IT spending took the form of a ‘knee jerk’ reaction to enable a remote workforce in a matter of weeks.

“As hybrid work takes hold, CIOs will focus on spending that enables innovation, not just task completion.”

Enterprise software and devices are topping the purchase list for companies across both countries, as they shift their focus to providing a more comfortable, innovative and productive environment for their workforces, Gartner says.

Enterprise tops the Kiwi list at 7.4 percent, followed by devices at 4.9 percent, while in Australia it’s the reverse, with devices clocking 9.0 percent growth and enterprise software hot on its tail at 7.3 percent.

Funds will more frequently come from departments outside IT and be charged as a cost of revenue or cost of goods sold.

The enterprise software category includes both application software, such as ERP and CRM, and infrastructure software like security and virtualisation.

When it comes to enterprise applications, the news is also positive locally, with spend forecast to grow 6.4 percent in New Zealand this year, hitting almost NZ$1.2 billion, and 7.7 percent in Australia to almost AU$10.8 billion.

CRM is expected to be the largest and the fastest growing enterprise application software category in New Zealand this year.

In Australia, it’s the second-fastest growing segment behind content services, which includes content collaboration platforms, however revenue for that is much lower, at just AU$570.6 million, a Gartner spokesperson told iStart. Spend on CRM in comparison is expected to hit AU$3.5 billion.

Demand for analytics and business intelligence is also gathering speed. The category was one of the few categories to post positive growth amid last year’s turmoil, posting a solid 3.8 percent increase in Australia. That’s set to accelerate this year to 11.9 percent – and $1.3 billion in spend – and 12.5 percent growth come 2022.

Demand in New Zealand, however is lower. Analytics and business intelligence posted a 0.38 percent decline last year, and is expected to see a 5.6 percent growth this year to NZ$174.3 million, followed by 7.7 percent growth next year.

Other hot categories include the much smaller supply chain management segment. Its 11.2 percent growth Australian growth comes off a low base and will see the segment hit $557.8 million, while in New Zealand a 7.4 percent growth will see it hit NZ$64.7 million. Both countries logged significant declines in supply chain management software spend last year, at -8.7 percent for Australia and -10.4 percent for New Zealand.

The pandemic has forced supply chain management front and centre for many, with the Suez Canal blockage further highlighting supply chains.

Previous reports from Gartner have highlighted increasing demand for real-time transportation visibility platforms, with the analyst firm saying that by 2023, 50 percent of global product centric enterprises will have invested in the platforms as they attempt to gain much needed visibility into the status of orders and shipments.

Demand for robotics goods-to-person systems in warehouses, enabling social distancing, are also on the up, Gartner says. It’s predicting that demand for the technologies, already in play at companies including Countdown in New Zealand and Woolworths in Australia, will quadruple through 2023.

ERP, the second largest of the enterprise application software segments in both New Zealand and Australia, also returns to growth, at 0.2 percent (to NZ$175.6 million) and 1.4 percent (to AU$2.0 billion) for Australia.

The overall IT spending growth won’t be driven by the traditional technology departments. Instead, Gartner points to business departments outside IT as being the new source for funds – a trend seen in recent years and now accelerating.

“The source of funds for new digital business initiatives will more frequently come from business departments outside IT and be charged as a cost of revenue or cost of goods sold,” Gartner says.

“IT no longer just supports corporate operations as it traditionally has, but is fully participating in business value delivery,” Lovelock says.

“Not only does this shift IT from a back-office role to the front of business, but it also changes the source of funding from an overhead expense that is maintained, monitored and sometimes cut, to the thing that drives revenue.”

Globally, Gartner is forecasting an 8.4 percent increase in spend to hit US$4.1 trillion this year.