Published on the 19/09/2014 | Written by Newsdesk

Chinese e-commerce platform Alibaba is set to make history with the biggest Nasdaq IPO on record…

If you haven’t heard of Alibaba, you should have. It is the largest e-commerce company on the planet, and is about to become the largest IPO, ever. It has always dreamed big. The Chinese company was founded in 1999 by 18 people who wanted to help small business leverage innovation and technology to better compete with the big boys both in China and overseas. It also thinks long term, planning to still be in business after 102 years, taking it into its third century.

During China’s equivalent of the Thanksgiving Day sales, Alibaba processed more transactional revenue on its own than all of America’s e-commerce sites combined.

Now it is set to make stock market history with the biggest IPO the Nasdaq has ever seen. Following overwhelming demand, Alibaba chose to increase its initial share price from $US60-$68 to $US66-68 which could bring it in excess of $US25 billion – more than the $US19.7 billion garnered by Visa upon its listing in 2008 and far greater than the nearest internet company, Facebook, which raised a paltry $US16 billion in 2012.

In a statement on the Nasdaq, Alibaba says it estimates that it will receive net proceeds from the offering of approximately $US8.1 billion after costs (assuming an initial offering price of US$67 per share) to be used for general corporate purposes, short-term debt instruments or bank deposits. It also states it does not plan to repatriate those funds back to China, adding fuel to speculation that it has the US and global markets in its sights.

The e-commerce behemoth is not well known in the Western world, but according to IDC it is the largest online and mobile commerce company in the world in terms of gross merchandise volume. It operates China’s three largest retail marketplaces including Taobao and Tmall; China’s largest global online wholesale marketplace Alibaba.com; and provides cloud computing services.

Alibaba chose to list on the New York stock exchange after attempts to do so on the Hong Kong exchange became entangled in market restrictions, not least of which was the potential for Yahoo, a 22.5 percent owner in Alibaba, to be forced to sell down its holding. Many have wondered if the likes of eBay and Amazon should be concerned. A brief scan of Alibaba’s filing shows, however, that it primarily views its growth to be in a Chinese context.

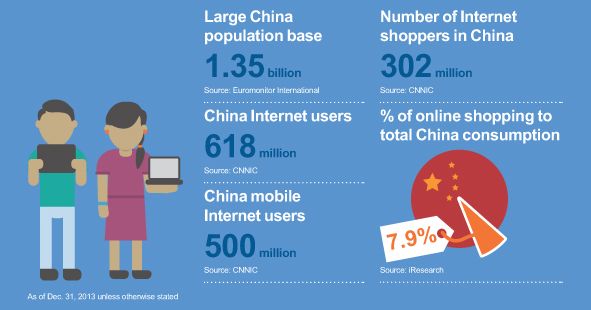

Outlining its market opportunity, it said “our business benefits from the rising spending power of Chinese consumers”. It says that China’s online shopping population is relatively underpenetrated but the increased use of mobile devices combined with underdeveloped physical retail infrastructure, limited product selection and inconsistent quality (through counterfeiting) in China will cause consumers to “leapfrog the offline retail market in favor of online and mobile commerce”.

In addition, according to Jeremy Hill writing in Forbes, “86 percent and 89 percent of its past two year’s revenues were from commerce in China when not including cloud computing and ‘other’ revenues”. Ovum principal analyst for the consumer sector, Eden Zoller, said that Alibaba’s plans to expand outside of Asia are a longer-term play and she expects them to “to put as much effort into growing business in its home market as it will into international expansion”.

Alibaba continues to use technology to revolutionise the retail experience, so if it moves into the US markets it will be one for the big players to watch. Taobao Marketplace is, for example, currently running a promotion to encourage buyers to purchase fresh produce direct from the country’s largest agricultural regions via the platform. The promotion aims to make China’s fresh produce supply chain more efficient by shortening the time between harvesting and consumers.

Co-founder Jack Ma, who has a net worth of $US21.9 billion, has also been focusing on his philanthropy more and more, setting up a $US3 billion charity trust in April and collaborating with Bill Gates. Indeed, he was this week named “Asia Game Changer of the Year” by the New York-based Asia Society for his company and philanthropic vision.

“One individual stood out in our selection process,” said Josette Sheeran, president of the Asia Society. “The truly game-changing nature of Jack Ma’s company Alibaba, and his philanthropic vision for China, have made him our Asia Game Changer of the Year.”