Published on the 31/03/2015 | Written by Clare Coulson

More than 25 years ago the launch of eftpos created a unique New Zealand payments ecosystem. Semble is set to do the same…

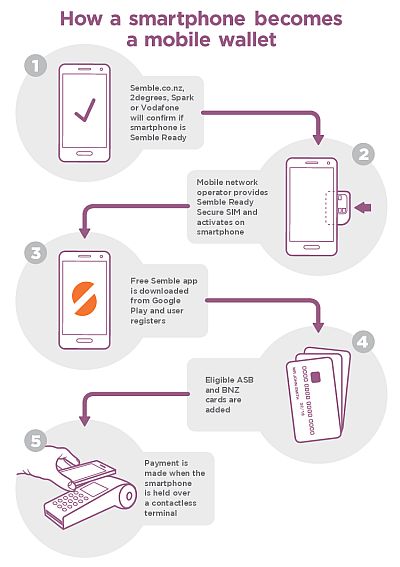

Semble has today launched contactless smartphone payments in New Zealand after a successful pilot. The Semble mobile wallet is free to use as long as the user has a Semble Ready secure SIM card, which contains a security chip like those used in credit and debit cards. Once enabled customers simply need to open the Semble app, swipe their phone at any contactless transaction terminal and confirm the transaction.

At the media launch, attended by a large number of the press corps, Semble CEO Rob Ellis said the partnership between Semble, 2degrees, Spark, Vodafone, ASB, BNZ and Paymark to offer a mobile wallet solution on a common national platform is “the first collaboration of its kind in the world”.

Semble launched with the payment transactions category but today announced that it will also be partnering with Snapper in the transport category (scheduled for a June start) and BurgerFuel in the vouchers and offers category. It is also in talks with Air New Zealand Loyalty, FlyBuys and Epay. These merchants will pay a fee to offer their services via the Semble wallet. Like eftpos, Semble does not clip the ticket on payments so the service remains free to customers. There is no word yet on whether Auckland Transport’s HOP Card will be available through the wallet.

Semble’s open philosophy means that eventually any organisation offering contactless transactions can be included in the wallet. “The real potential of this is for SME businesses around New Zealand who typically don’t have an app, and don’t want an app, but want to access their customers via mobile,” said Ellis. This could come in the form of mobile marketing, but he thinks it’s more likely to be related to loyalty – for example, a café that has a paper-card based loyalty system at present could pay to use the Semble platform.

Semble’s open philosophy means that eventually any organisation offering contactless transactions can be included in the wallet. “The real potential of this is for SME businesses around New Zealand who typically don’t have an app, and don’t want an app, but want to access their customers via mobile,” said Ellis. This could come in the form of mobile marketing, but he thinks it’s more likely to be related to loyalty – for example, a café that has a paper-card based loyalty system at present could pay to use the Semble platform.

“The nirvana ultimately is a single tap experience where you are redeeming an offer, you’re getting a discount, you’re earning points or redeeming points and you are paying all at the same time.” There is also the potential role for Semble in the future to provide anonymised aggregated data analytics, with the permission and involvement of the service providers.

“What’s important now is to get enough services in to Semble as soon as possible to make it useful on a daily basis. Once there is a wider range of services you have a very interesting data set to analyse, which helps provide better service,” Ellis said.

There are some barriers to wholesale adoption, however, as the service will initially be available only to customers of ASB and BNZ who have an NFC-capable Android smartphone (of which there are 21 models). Admittedly that is a reach of some one million-odd potential bank customers, but these customers will also have to obtain the new SIM, which will slow down uptake. It also leaves iPhone users out in the cold.

Apple finally added NFC capability to its latest two phone models in September last year, and launched Apple Pay. Apple Pay remains Apple-only for now and is also only available in the USA, but Ellis said he is looking forward to discussing the opportunity with Apple when the time comes. In the meantime he said, Android holds 75 percent of the smartphone market share.

When asked if he was concerned that only two banks had chosen to join the collaboration, Ellis said “it is a great start to have two banks involved” and Semble is in discussion with Kiwibank, TSB, The Cooperative Bank, Union Pay and a number of others. Because Semble is vendor agnostic it is also still in discussions with ANZ despite that bank’s plans to upgrade its own mobile wallet.

Paymark CEO Mark Rushworth pointed out that when eftpos originally launched it began with two banks but has grown to be the general modus operandi for New Zealand. He also said that Kiwis are generally early-adopters and that Paymark is seeing the number of contactless payment transactions increase by 18 percent a month. “Semble will take us to the future where the payment card becomes a thing of the past,” he predicted.

Anthony Healy, CEO and managing director of BNZ added that it is a rare thing to see the brands of three telcos and two banks working together. “It is a sign of the importance of building an ecosystem like this,” he said.

TUANZ CEO, Craig Young, was very positive about the potential uptake of the mobile wallet. “I think if you get Millennials and the next gen to start using their phones for these sorts of transactions and especially if you get public transport on to it, it’s really going to take off.”

I am looking for a site that i had bookmarked in 2012 that compared costs between countries and over time on the istarts website: http://www.istart.co.nz/index/HM20/PC0/PVC197/EX245/AR28720.

on it i could calculate the cost of a five minute mobile call on either Telecom or Vodafone prepay network plans as $4.45 and given the 2006 New Zealand adult minimal wage after tax being $8.26 an hour, this equates with having to work 32 minutes to pay for a five minute prepay call.

Is this still available at all as i am wanting to cite it.

Is this the story you were looking for — https://istart.co.nz/nz-news-items/mobile-termination-the-big-mac-index/

Ailsa – you might also be interested in a more recent story on a similar topic:

https://istart.co.nz/nz-news-items/spark-challenges-comcom-copper-pricing-model/